There may be no market or industry Amazon isn’t trying to get into (or dominate further). This week, its acquisition of Whole Foods became all too real as the chain slashed prices across the board in accordance with Amazon-ian operating procedures. We have made note, many times, about how Amazon’s cloud service AWS is one of the most important players in one of the largest tech growth industries in the world. Amazon has doubled down on machine learning and artificial intelligence, paving the way for a turbo-charged tech future. And, a huge piece of that A.I. horsepower is currently expended in service of natural language recognition and processing — namely, in the form of the Amazon’s Echo, powered by Alexa.

It’s no secret Wal-Mart holds Amazon in less than the highest esteem. They are natural rivals fighting for the future of retail (whether physical or e-commerce). They’re already fighting over cloud storage; now it appears they’ll do battle in the arena of voice-based shopping as well. But this time, Wal-Mart recruited a heavyweight partner in crime to help their rivalry:

Google.

Amazon already dominates both the home-based voice-controlled device market, and as such, is winning the voice-enabled shopping war at the moment. Now, that market isn’t massive just yet, but it’s a large and growing retail segment. Karen Hao writing for Quartz puts the stakes in context nicely:

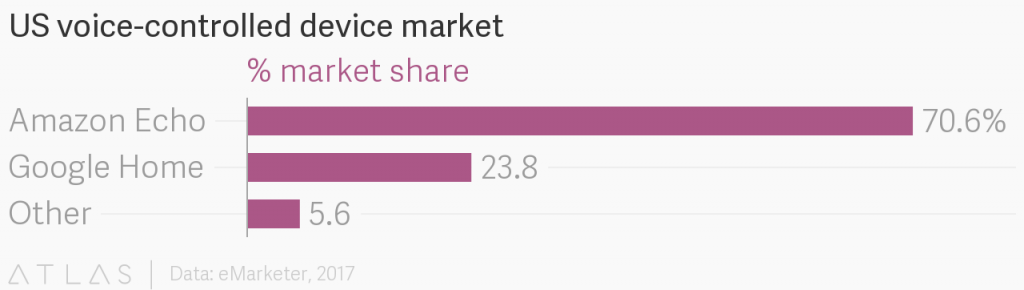

In a blog post published today, Marc Lore, CEO of Jet.com, the e-commerce company Walmart acquired in September 2016, said users will be able to purchase Walmart products through Google’s voice assistant starting in late September. The collaboration challenges Amazon’s current dominance of the market for shopping with voice-controlled devices. Amazon’s Echo devices currently account for 70.6% of the voice-controlled device market, while Google Home captures 23.8%, according to 2017 data from the research firm eMarketer.

While the voice-enabled shopping sector isn’t huge yet, growth rate is a strong indicator of future performance in these fields. As it stands, both Wal-Mart and Google are trailing Amazon pretty significantly. Per Hao at Quartz again:

Using a voice device to shop is a growing category of e-commerce. Currently, Amazon captures 43% of all online sales revenue and 53% of online sales growth, according to a February 2017 analysis by Slice Intelligence. Walmart presumably hopes its Google agreement will help it catch up; during last week’s earnings call, the company reported 60% growth in online sales during its second quarter, following 63% growth in the first quarter.

Both Amazon and Wal-Mart are augmenting their online sales growth figures quarter after quarter, any competitive advantage must be sought or minimized, depending on your respective company and position. As such, it makes total sense for Wal-Mart and Google to team up to take on Amazon. Both companies are titans of their respective fields, just without the horizontal integration to compete head-to-head with Amazon on their own, individually. This partnership allows Wal-Mart to utilize Google’s expertise in artificial intelligence, consumer personalization via big data, and Google Assistant’s preexisting hardware platform, voice recognition and natural speech comprehension capabilities.

On the flip side, for all that platform and data support Google provides, they get back an unescapable retailer with a sophisticated distribution and fulfillment operation itching to sell more goods to more consumers through the burgeoning online retail channel. Wal-Mart automatically makes Google competitive with Amazon on the retail front, and Google can stop sending quite so much money to Amazon’s e-commerce operation with a built in retail partner for Google Home.

Amazon is trying to give Wal-Mart fits on all fronts — Wal-Mart has signaled it does not plan to take it lying down.

Jeff Francis is a veteran entrepreneur and founder of Dallas-based digital product studio ENO8. Jeff founded ENO8 to empower companies of all sizes to design, develop and deliver innovative, impactful digital products. With more than 18 years working with early-stage startups, Jeff has a passion for creating and growing new businesses from the ground up, and has honed a unique ability to assist companies with aligning their technology product initiatives with real business outcomes.

Sign up for power-packed emails to get critical insights into why software fails and how you can succeed!

Whether you have your ducks in a row or just an idea, we’ll help you create software your customers will Love.

LET'S TALK